© a.s.r. 2026

09 October 2020 | 7 min.

Before the COVID-19 pandemic, shopping in city centres, dancing in nightclubs, and driving to work every day were things we all took for granted. Nowadays, we mostly stay at home, having adopted an increasingly digital way of living and working. And just as the COVID-19 pandemic has heavily impacted our normal lives, so has its impact been felt in the various real estate sectors.

a.s.r. real estate has been investing in real estate for more than 125 years and manages investments for institutional investors. Long-term thinking is in our DNA, with a strong focus on quality. This is based on our belief that a quality investment will retain its value in times of stress. We invest in sustainable regions, cities and buildings, and we actively encourage sustainable land use.

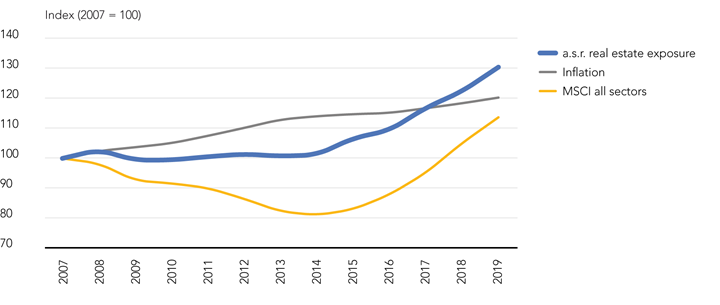

Due to the diversified real estate portfolio, our real estate platform (direct residential, retail, office, science parks and farmland investments in the Netherlands and indirect non-listed European real estate) has performed well in recent years and shows resilience in times of crisis. For example, while the Dutch real estate benchmark depreciated by -19% during the Global Financial Crisis (2007 -2014), the a.s.r. real estate portfolio showed a continuous value increase of 1.2% over the same period.

Figure 1: asset value index a.s.r. real estate portfolio versus MSCI-NL property benchmark

Focused core investment strategies and asset selection have proven highly successful and offer investors a safe haven in challenging markets. During the global financial crisis and years following (2007-2014), the indirect return of a.s.r.’s office portfolio outperformed the benchmark by an annual average of 75 bps. Even more notable was our retail portfolio, which outperformed the benchmark by an annual average of 250 bps during devaluation years (2008-2009, 2012-2016 and 2019). The residential portfolio also performed well in the past years, matching its relevant benchmark. The residential sector showed a very strong capital growth compared to other real estate sectors. Meanwhile, we continue to work on making it an even more sustainable portfolio. This is also an important focus for our balanced core international portfolio that invests in best in class non-listed European real estate funds. This strategy diversifies the a.s.r. real estate exposure and supports its stability over the economic and real estate cycle. The farmland portfolio provides a stable and secure income over the last years and has proven to be an unique and stabilising factor in a.s.r.’s asset allocation. Especially during economic downturns the asset class proved to be more resilient and less volatile than other real assets.

The previous global financial crisis is still etched in our memories. A focus on core investments helped a.s.r. real estate remain stable during that crisis. We finetuned our core investment strategy and were therefore well prepared for the current crisis. As a general rule, we would rather stay on track with our long-term strategies than allow ourselves to be tempted by more opportunistic transactions.

Investments based on refined, solid investment strategies have proven to be resilient during times of crisis. a.s.r. real estate has developed appropriate strategies for each sector fund, based on each sector’s long-term background, our research tools and knowledge of real estate markets.

a.s.r. real estate welcomes the future with confidence, given our solid, sustainable real estate platform and refined investment strategies.

In the coming years, we will closely monitor our strategies, invest in innovation, and further develop our data-driven approach towards real estate investments. Solid data-science techniques, such as machine learning, geographic information systems, and business intelligence tooling, will be used to sharpen our strategies. This will enable us to keep delivering perpetual value to both our investors and society.