© a.s.r. 2026

12 June 2020 | 3 min.

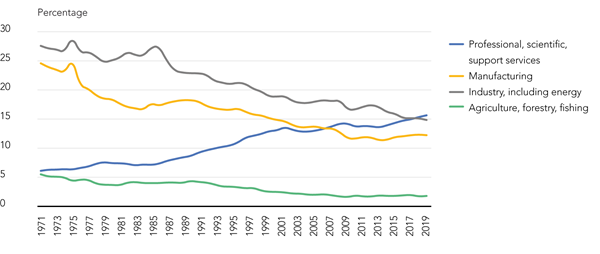

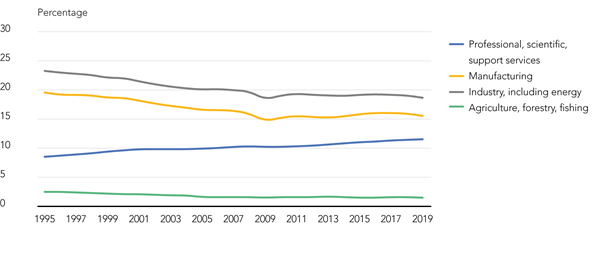

In recent decades, there has been a steady global shift towards a more knowledge-based economy. Companies which have been able to capitalise on relatively recent scientific discoveries and research have grown rapidly, with some of them now among the world’s most valuable companies. This trend is also reflected in the figures for the economy as a whole, and is particularly evident in countries such as the Netherlands, where the manufacturing, industry and agricultural sectors have been declining in importance in the economy over the last five decades, while professional, scientific and support services have tripled in size (figure 1). The growth in the latter sector has been significant, particularly when compared to the European average (figure 2). In relation to Europe as a whole, the Netherlands is a frontrunner in the gradual shift away from economic activity based on natural resources and industry and towards a more knowledge-based economy.

Figure 1: Share of GDP across the main economic sectors in the Netherlands

Source: OECD, 2020

Figure 2: Share of GDP across the main economic sectors in Europe

Source: OECD, 2020

This gradual reorientation of the Dutch economy has affected the demand for real estate. As the ability to capitalise on scientific and engineering knowledge has grown, the locations where knowledge can be shared and commercialised the most successfully are benefiting disproportionately. This has given rise to rapid growing clusters of knowledge-intensive companies, which benefit from each other’s presence, known as science parks.

The ASR Dutch Science Park Fund invests in locations in the Netherlands where the added value is most present often “permanently” anchored by a strong knowledge institute such as a university. Besides adding value to companies in their vicinity, universities also provide the type of long-term stability that a.s.r. real estate looks for in all its real estate investments, in line with its core investment creed; ‘investing with perpetual value’. The Fund has used its bespoke Science Park Filter to select ten locations that excel on four key criteria: the strength of the knowledge anchor, the quality and size of the ecosystem and the regional economic strength, as well as the strength of the local real estate market.

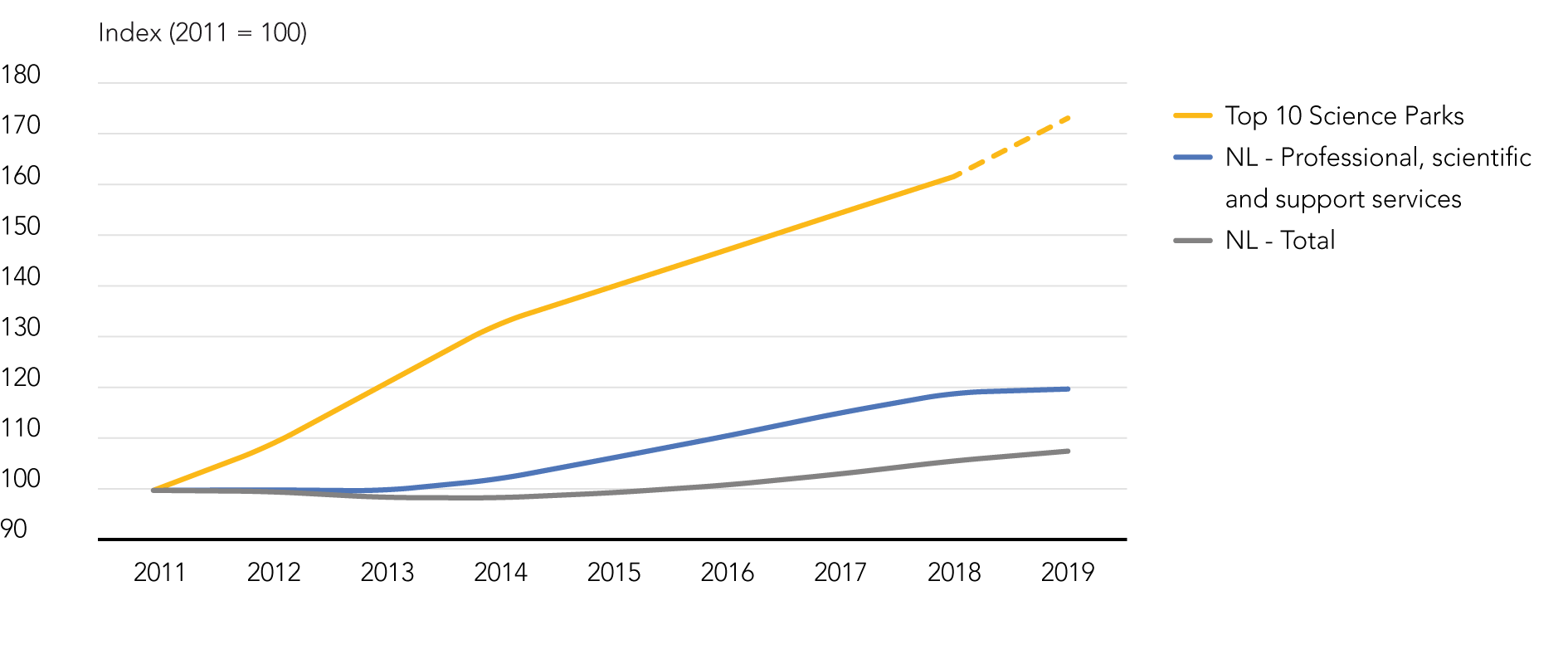

Due to the significant added value for commercial activities, employment and company growth in these ten leading science parks has increased significantly in relation to the national average. Employment in the Netherlands grew by 0.9% y-o-y between 2011 and 2019 (Figure 3). Over the same period, the growth in commercial employment in the Fund’s top-ten science parks outpaced the Dutch average significantly at over 70% between 2011 and 2019, which equals average y-o-y growth of 7.1%.

Figure 3: Employment growth compared (index 2011 = 100)

Source: Statistics Netherlands (2020), BCI (2019)

Science parks data for 2019 is not yet available; growth trend between 2011-2018 is shown

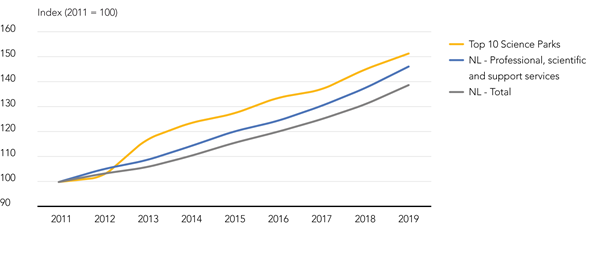

Figure 4: Company growth compared (index 2011 = 100)

Source: Statistics Netherlands (2020), SIZO (2019)