© a.s.r. 2026

03 April 2022 | 3 min.

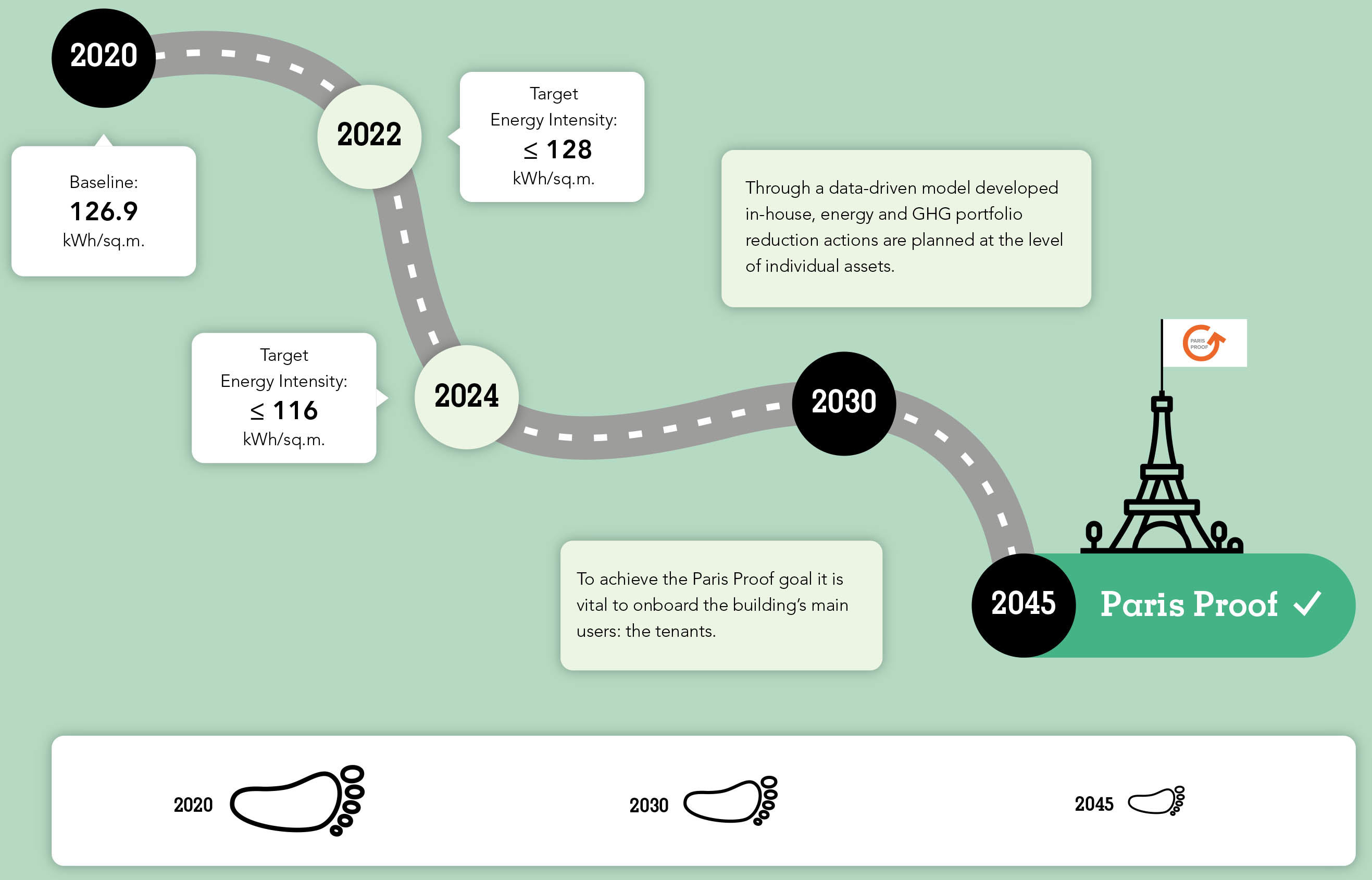

By our investments in real estate, we aim to make a positive impact on nature, society and the climate – today and for future generations. We will achieve this by reducing GHG emissions, accelerating the energy transition, and reducing waste and water consumption, leading to a climate-adaptive and Paris Proof portfolio. For the latter, we designed roadmaps for our Funds to lead us to a CO2-neutral portfolio by 2045.

GHG emissions have steadily increased in recent decades, leading to rising temperatures around the globe. Real estate is responsible for a large portion of GHG emissions, thus making it a major contributor to global warming. To reduce this, a.s.r. real estate signed the Paris Proof Commitment of the Dutch Green Building Council.

In 2020, several institutional investors, mainly in real estate, signed the Paris Proof Commitment of the Dutch Green Building Council, dedicating themselves to achieving a GHG neutral portfolio by 2050.

Read more [dutch only]

However, in the Netherlands, the current pace of the energy transition is too slow. This leads to climate related incidents, such as floods and the urban heat island effect, occurring on a more regular basis. So a.s.r. real estate decided upon an even more ambitious goal: to realise its energy-efficient portfolio five years earlier than the Paris Proof Commitment, speeding up the process with the aim of achieving our Paris Proof commitments before 2045.

To reach our goal by 2045, each Fund has drawn up a Paris Proof Roadmap. This was done with the help of the CRREM tool, developed by the EU for investors in real estate, to measure an asset’s exposure to emission-related risks. The outcome, combined with our in-house data model, has led to a.s.r. real estate’s overall objectives. Our roadmaps have been drawn up and will be implemented with the following steps:

Paris Proof Roadmap a.s.r. real estate

A baseline measurement was conducted of all our assets, which included figures for the energy intensity of each one, the energy use distribution, the level of insulation, and the type of installations currently in use overall.

Our asset managers and external advisors determined actions that need to be taken for each asset in order to measure the reduction in energy intensity and GHG emissions.

These actions include:

All asset-specific measures are combined to generate a portfolio level overview that includes a timeline indicating which measures should be taken between now and 2045. The model continuously keeps track of our actions so that we can be assured of reaching our Paris Proof goal.

The Paris Proof Roadmap allows our Funds to integrate the right sustainability measures at the right time in the multi-year maintenance plans. This enables us to use those moments when maintenance naturally occurs to increase the energy efficiency of assets in a cost-efficient way.