© a.s.r. 2025

29 December 2022 | 3 min.

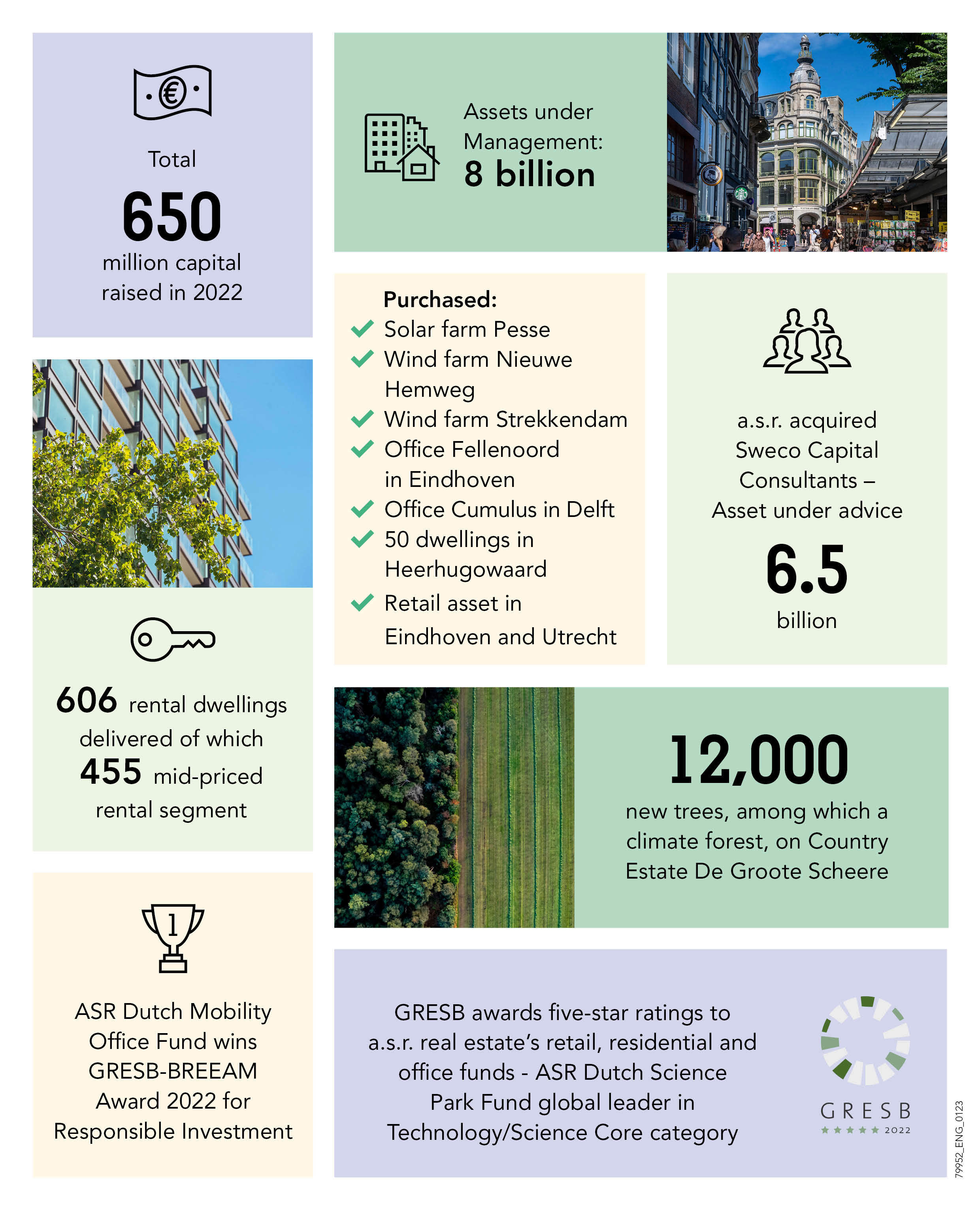

a.s.r. real estate closes the year with over €650 million of capital raised and a total invested assets of €8 billion. These assets, from 30 institutional investors including a.s.r., were invested in 2022 in, among other things, the purchase of offices in Eindhoven and Delft, retail properties in Utrecht and Eindhoven and 50 homes for people over 55 in Heerhugowaard. In addition, a.s.r. real estate also purchased two wind farms and a solar park on behalf of a.s.r., and had more than 12,000 new trees planted that will be good for the storage of 1,600 tons of CO2 in the future.

Dick Gort, director a.s.r. real estate: "2022 was a successful year for a.s.r. real estate. We were able to make an impact in the real estate market in the broadest sense of the word. Both by increasing our invested assets and by investing in projects that are sustainable and promote energy transition. In addition, we look back with pride at the acquisition of the activities of Sweco Capital Consultants with €6.5 billion in assets under advice. That offers new opportunities for the future.'

With a commitment of €250 million in the residential fund, a.s.r. real estate concludes a year in which it has made great strides in the field of sustainable housing investment. As such, the residential fund grew in recent years to a size of €2.2 billion. In 2022, 606 rental dwellings were completed, 455 of which were in the mid-priced rental segment. 35 dwellings were rented with priority to people over 55 in Heerhugowaard. In addition, 169 dwellings in Huizen were made more sustainable.

On behalf of a.s.r., a.s.r. real estate invested in two wind farms last year. This brings the total to four wind farms, which together can provide more than 200,000 Dutch households with sustainable electricity. Also in 2022, a.s.r. bought the newly realized solar park in Pesse. This solar farm in Drenthe, with over 60,000 panels, has a capacity of 32.6 megawatts and supplies the electricity needs of approximately 11,500 households. Over the past year, a.s.r. real estate also installed additional solar panels on stores, homes and office buildings, bringing the total number of solar panels to 80,000. In addition, in April a.s.r. real estate added 12,000 new trees, including a climate forest to its portfolio, good for the storage of 1,600 tons of CO2 over a number of years.

a.s.r. real estate manages five real estate funds. These are the retail fund, office fund, residential fund, science park fund and the rural real estate fund. This year, the retail, residential, and office funds received the maximum score of five stars in the GRESB benchmark. This means that these funds are among the 20% most sustainable GRESB funds in the world. The science park fund received four stars and was named Global Non-listed Sector Leader in the Technology/Science category.