© a.s.r. 2025

28 February 2018 | 3 min.

Real estate is a relatively illiquid asset class. Listed and non-listed real estate funds provide a more liquid alternative than direct real estate. Listed real estate funds are fairly liquid and relatively homogenous in the form of Real Estate Investment Trusts, while non-listed real estate funds are structured very diversely, with varying levels of liquidity. Many investors however, prefer non-listed real estate funds as these type of funds are highly correlated to real estate as compared to listed funds, which are more correlated to stocks.

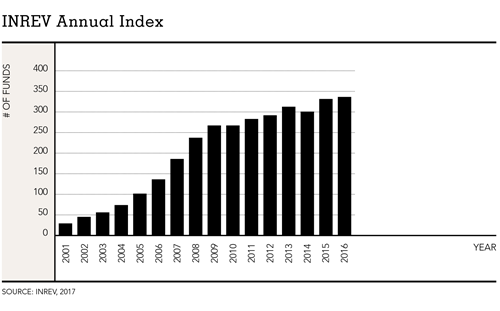

The non-listed real estate fund industry has developed strongly over the last few decades. The establishment of the European Association for Investors in Non-Listed Real Estate Vehicles (INREV) in 2002 has been supportive of this, allowing fund managers to compare and structure funds tailored to the needs of investors. The amount of non-listed real estate funds included in the INREV Annual Index increased from 29 in 2001 to 339 in 2016, demonstrating the increased interest in non-listed funds and the industry’s goal to improve transparency.

INREV is a driver behind increased transparency and standardization of the industry, but also challenges fund managers to be critical of themselves, through for example self-assessment tools which provide fund managers and investors with a benchmark to compare non-listed funds on corporate governance, fees, sustainability but also liquidity. This has encouraged fund managers to develop liquidity mechanisms that could improve the overall attractiveness of non-listed real estate funds.

The Dutch real estate market is one the most transparent and mature real estate markets (#7 in the JLL Transparency Index 2016) globally, providing an attractive destination for real estate investment. The Netherlands is, not surprisingly, well represented in the non-listed real estate industry as indicated by their active contribution within the INREV. Two commonly used structures for non-listed real estate funds are the FBI (Fiscal Investment Institution) and the FGR (Fund for Joint Account), more on this in the article “FGR: the Dutch non-listed real estate vehicle standard”. The FBI, which has been frequently used for both listed and non-listed vehicles for many decades, could be negatively impacted as the last Dutch coalition agreement of 10 October 2017 has indicated that FBI’s are no longer authorized to invest directly into real estate. The FGR structure has been used more recently by Dutch investment managers, including a.s.r. real estate, and is characterized by more favorable liquidity mechanisms. Not only do FGRs offer an attractive redemption facility, they also provide the investors with the possibility to exchange their shareholding by way of a secondary transfer.

It is estimated that the secondary trading volume has quadrupled on an annual basis in the period 2010-2015, to a level of $ 9.0 billion globally. The a.s.r. sector funds (by means of their Fund Agreements) are well positioned to facilitate secondary trading, as an increasing number of trading platforms are being established and this market niche is rapidly professionalizing. Alongside flexible secondary trading options a.s.r. real estate offers an attractive redemption facility, fully supporting investors that are less keen to trade on the secondary market to exit their investment. The level of liquidity of its funds is continuously assessed by a.s.r. real estate. Improvements to fund structure and liquidity are always considered, bearing in mind the operational excellence of its funds and the stability of the investment value of its shareholders.